|

Companies that have no connection to the financial world - Mindbody (fitness), ServiceTitan (HVAC, plumbing), WonderSchool (daycare), Jobber (lawncare, painting) - are suddenly making more revenue from online payments and other financial services than they do from their core software subscription revenue. This is because new Fintech infrastructure companies have made it possible for SaaS businesses to add financial services alongside their core software product. By adding Fintech, SaaS businesses can increase revenue per customer by 2-5x, according to an a16z analysis, a significant new market opportunity and indicator for what might be to come in the future. The First Step: SaaS Companies Processing Their Own Payments From Forbes: “By looking at several examples of fast growing vertical SaaS companies, we observe a fundamental business model shift taking place whereby vertical SaaS companies are becoming SaaS + payments companies, and by doing so are creating mega-opportunities in deceptively small markets.” By integrating payments functionality into their product, MindBody captures a significant new revenue stream and increases their TAM by 41% to $1.2 billion. Not only are they generating a high margin recurring SaaS licensing fee but they are taking a cut, roughly 80 bps of payment volume according to their public filings, of every dollar their customers make. While MindBody was one of the early vertical SaaS companies to integrate payments as a key and differentiating product feature, they are not alone as a handful of successful and scaling vertical SaaS companies have followed suit. Other examples:

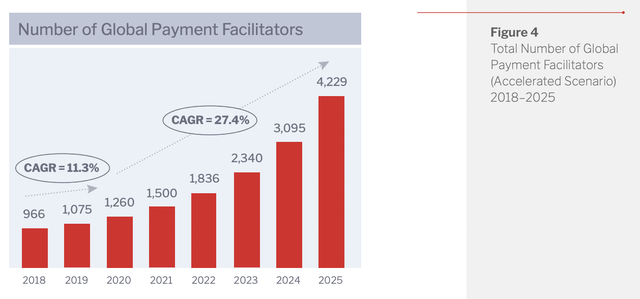

These software companies’ stated primary line of business is to license their software on a monthly subscription. MindBody’s gym owner customers pay MindBody a monthly fee. Plumbers pay ServiceTitan a monthly fee for use of their software. However these software companies have introduced a new line of business – payment processing. When the gym owner signs up a new customer, that customer pays their gym fee via MindBody. When the plumber finishes a job, the customer’s payment is processed online via ServiceTitan. They don’t achieve this via Moneris or PayPal, they have built the payment processing technology and links to payors themselves, and collect a % on each payment. Because these businesses provide software that helps facilitate the interaction between business and customer, it allows them to be integrated into the payments flow and actually be the payment processor for its SaaS customers. "These examples are only a handful of the vertical end markets where SaaS+payments business model makes sense, but there are many more. What is clear is that the next generation of vertical market SaaS businesses should incorporate payments functionality directly into the product feature-set and take a cut of that payment flow rather than outsource those payments to external providers.” The Future? FinTech, InsureTech Adding direct payment processing is a natural first step, but in the future market analysts speculate that SaaS companies could add the full stack of FinTech and Insurance capabilities to their standard offerings. Consider: traditional insurance is highly inconvenient: I purchase my asset (house, car, lease on an office), but then I have to go somewhere else to buy insurance. It would be natural and highly advantageous to be able to embed insurance at the point of purchase. “Insurtechs” are able to better acquire customers (“would you like some insurance with that?”) and better select risk by leveraging the data of the hosting SaaS platform. Growth of Global Payment Facilitator (PayFac) Population A 2019 analysis forecasts the number of “global payment facilitators” will increase as high as at 4,229 by 2025: One of the drivers of this growth: “It is becoming increasingly popular for software companies to begin taking more control of the payments process on their platform by becoming PayFacs. When a software company becomes a PayFac, they take ownership of the payments portion of their software and handle many of the payments responsibilities that previously were held by 3rd parties. […] When acting as a payment facilitator the software company is responsible for payments functions, such as getting the merchant approved and set up to begin accepting payments, determining the fee the merchant pays for each transaction, funding of the merchant (getting the appropriate amount of money into the merchant’s bank account), ongoing monitoring for fraud or other suspicious activity to ensure a safe payments ecosystem, and handling chargeback requests”. This forecast was prepared by “AZPG calculations using data from Double Diamond Group / Infinicept, Boston Consulting Group, Cap Gemini, World Bank, Bank of Mexico, Visa, MasterCard, PayPal, Square, Shopify, Owler.com, Clearbit.com, interviews with global payments consultants, integrated payments executives, payment facilitators, and others”. What Types of Software Companies Are Becoming PayFacs? Credit Suisse categorizes 3 types of software companies that are becoming payments facilitators:

Proliferation of Businesses That Help Software Companies Become PayFacs It seems the barrier to entry to becoming a PayFac has been lowered by a proliferation of small companies offering a service to help you become a Payment Facilitator, such as PayEngine, Infinicept, Payrix, Amaryllis, Tilled, Finix, TSYS, and AgilePayments. A sampling of some of these companies’ recent marketing:

But it’s not only startups who are offering to help software companies ‘own payments’. Large established payments companies are also offering to help new entrants in the payments market, for example:

As the saying goes, who made the most money during the gold rush? It wasn't the gold diggers, it was the people who sold them shovels! Cost of Becoming A Registered Payments Facilitator From Infinicept: "Although the benefit of becoming a payfac is greater control and higher profit margins, the initial and ongoing investment is steep, including:

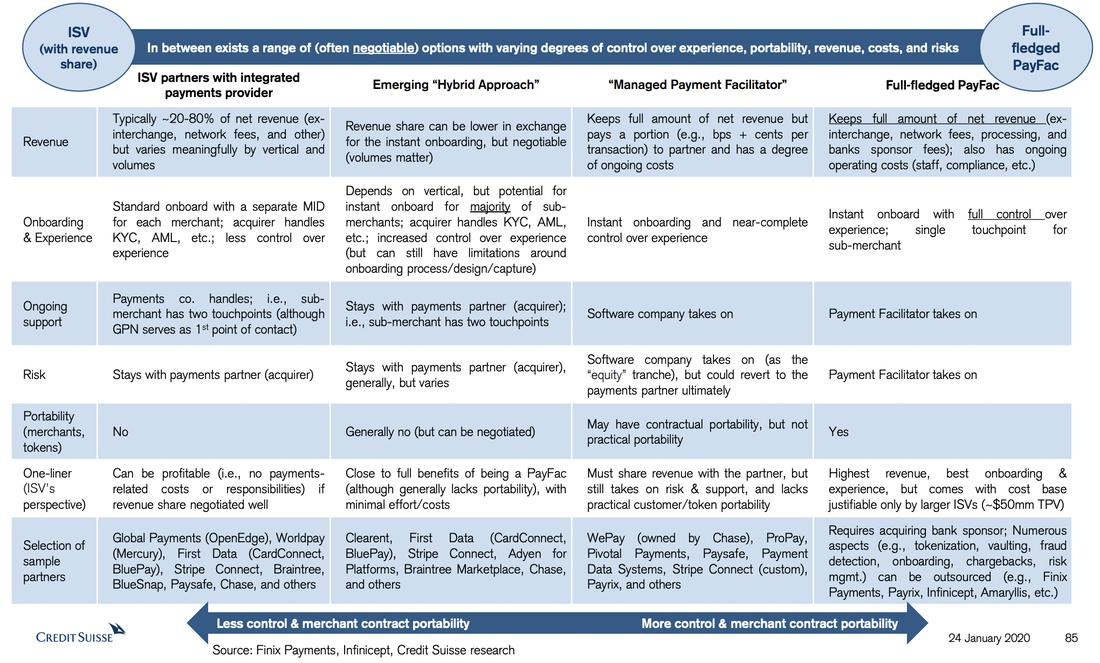

Payment infrastructure companies like Infinicept suggest that they can help you become a full-fledged payments company but list out these high costs to highlight their real value proposition: use their services and infrastructure to fast-track your entrance into the market and avoid the barriers to entry. Different Business Models: Registered Payment Facilitators and Hybrid Payment Facilitators When a company like PayEngine, Payrix, or Stripe helps you become a PayFac, they all offer a range of models, from helping you become a full-fledged payment processor (where you bear all of the aforementioned costs, plus the risk and compliance responsibility), to hybrid options such as “Managed PayFac” and “Hybrid PayFac”, where the software company and the enabling FinTech “share” the risk and responsibility. From Credit Suisse: The terminology of this industry appears to be in flux. What exactly is meant by a "PayFac", a "Managed Payment Facilitator", and a "Hybrid Payments Company"? In each case, the specifics of what a software company is signing up for when engaging one of these services from a Stripe or an Intercept are not explicitly listed on the vendor's websites, and it's hard to tease it out from their marketing. What About Regulatory Compliance? If you are a software company that is adding your own payments services using a hybrid model, it’s not clear to me whether you would be considered a regulated entity under PSD2 and be supervised by regulators like the Financial Conduct Authority (FCA). For example if you’re becoming a Hybrid PayFac by making use of Stripe Connect, apparently you aren’t in scope of PSD2 or the FCA. "With Stripe Connect, Stripe contracts with both the Seller and the Platform to settle payments to the Seller and fees to the Platform. Funds that are owed by the Buyer to the Seller are never in the possession or control of the Platform. Instead, these funds are settled to Stripe’s regulated client money bank account for the benefit of the Seller, before being paid out to the Seller by Stripe. The regulated payment services are rendered by Stripe instead of the Platform, so the Platform does not incur the significant regulatory and compliance overhead of getting a payments license or exemption." Indeed, Shopify uses Stripe Connect for its payments and yet Shopify doesn’t appear on the FCA registry, only Stripe does. However Stripe is the only company listed in this article that promises to handle PSD2 requirements on behalf of the PayFac. All the other companies - PayEngine, Payrix, etc. – are silent on PSD2, focusing only on helping companies either meet PCI compliance, KYC and AML, or taking the PCI/KYC/AML responsibility partly or fully away from them, depending on the hybrid model.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |