|

The Empire State Building was built in just 410 days. Disneyland was brought to life in 366 days. The Javascript language was prototyped in 10 days, and launched 4 months later.

How were these and other major feats accomplished so quickly? And what lessons do they hold for managers looking to deliver fast today?

0 Comments

Talking to customers to uncover unmet needs is one of the most exciting parts of product management. It's being a detective! Hunting down members of your target audience for meetings, and, once there, asking them the right questions to get to the root of what they really care about.

But most PMs find it difficult to book customer interviews on a regular basis. And even when you do land a customer interview - how do you carry it out? What questions do you ask? This article is a step-by-step guide to landing and executing customer interviews - taking the stress out of it and making it fun! You can't be a PM or business owner without a deep understanding of machine learning: establishing the business value and then rallying a team to deliver to that value without falling into the many unique pitfalls of ML programs. Here is a "cheat sheet" compilation of how to deliver machine learning products and programs, highlighting practical tips from someone who's been on the journey.

There's a vast difference between an average project manager and an excellent project manager. But if you google "What makes a great project manager?", you find only generic lists of qualities: organized, good communicator, blah blah blah.

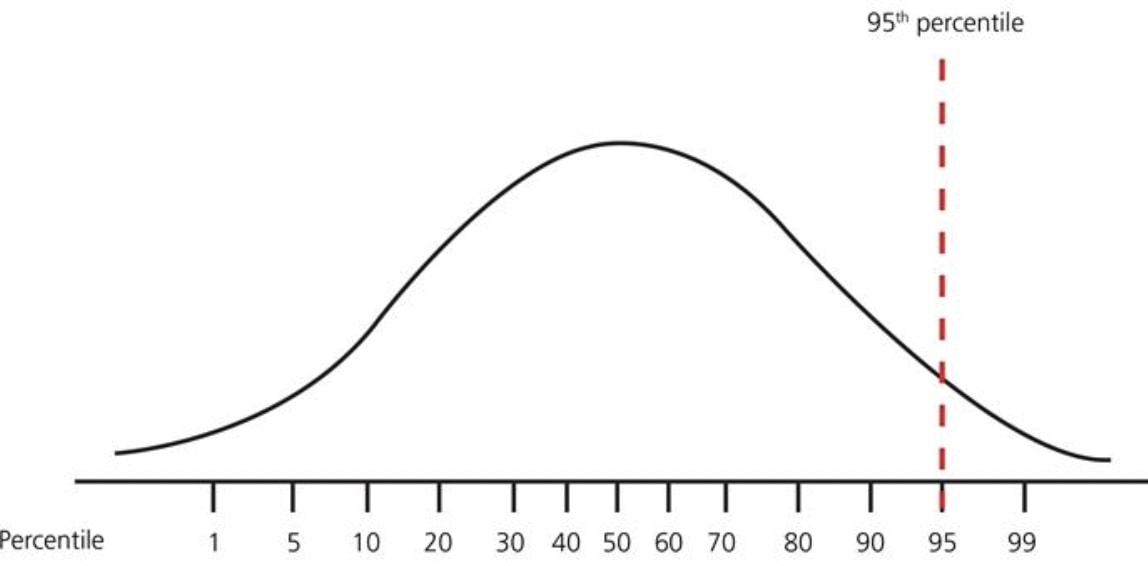

Of course it's important to be organized and communicate well. But that's just the starting point. Let's get more specific. What are the traits are we looking for that truly separate the top tier PMs from all the rest? Earlier this year I wrote a tongue-in-cheek post to illustrate how to 'hack' the LinkedIn algorithm to get a lot of views. It took me 2 minutes to write a post, and I got over 2,000 views just that day.

The AWS Solutions Architect Associate (SAA-C03) exam covers a breadth of topics, including the right choice of AWS services under different conditions and constraints, setting up high-availability architectures, disaster recovery, hybrid cloud models, networking/routing traffic in different configurations, etc.

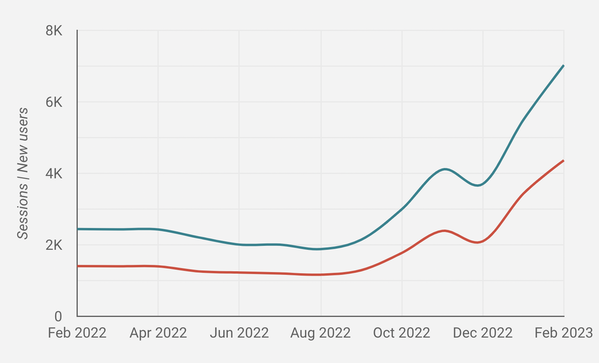

Product-market fit is the degree to which a product satisfies a strong market demand. It is widely considered to be the first step to building a successful venture, whether a new startup, a new business unit or product within an established company.

Only 4% of startups make it past the seed funding stage, and from there, only 70% go on to generate consistent revenue, according to the How To Win podcast. The most common reason is simply a failure to find enough customers. Those percentages are even lower when you factor in failed product launches at established companies. Product-market fit eludes so many. So what are the secrets to achieving product-market fit? And how do you know when you've got it? Consultants will tell you that it takes time for a new website to rank highly with Google SEO. Yet I was able to get some of my new website's pages to rank #1 within a few weeks, without any paid ads.

I have done program management, business development and marketing for 20 years, but I'm no SEO expert. But since I had some success just experimenting with SEO part-time, I thought to share my findings.

CIOs (Chief Information Officers) are smart, busy, and flooded with meetings. Internally, their peers and teams are constantly notifying them of status and new fires. Externally, they are flooded by sales calls. It's exhausting.

So how do you get an audience with them? And when you do, how do you get their attention and respect? In short: how to talk to a CIO? It's never a great sign when the Product Manager is handed a technology with an assignment of "figuring out the use cases". Great products should be a labor of love, the result of an entrepreneurial person who felt the pain of a problem first-hand, or had great empathy for someone else's problem, and then passionately invested time and energy to solve that problem.

The entire Wikipedia entry for Web3 is being considered for deletion by moderators due to the general lack of clarity on what Web3 actually is. Indeed, it took me several days of reading Web3 silicon valley articles and podcasts, and contrasting them with other reputable analyses, to piece it together.

This post cuts out the jargon and summarizes in plain language what Web3, NFTs, and the Metaverse are, how they're tied together, as well as the known issues of the technology and business model behind them. The Amazon AWS Cloud Practitioner (ACP) certification requires learning the basics of the AWS service suite (over 200 services!), fundamental AWS pricing, and cloud architecture best practices such as high-availability architectures, hybrid on-prem/cloud, and disaster recovery. Here are my study notes that may serve as a "cheat sheet" for others preparing for this exam.

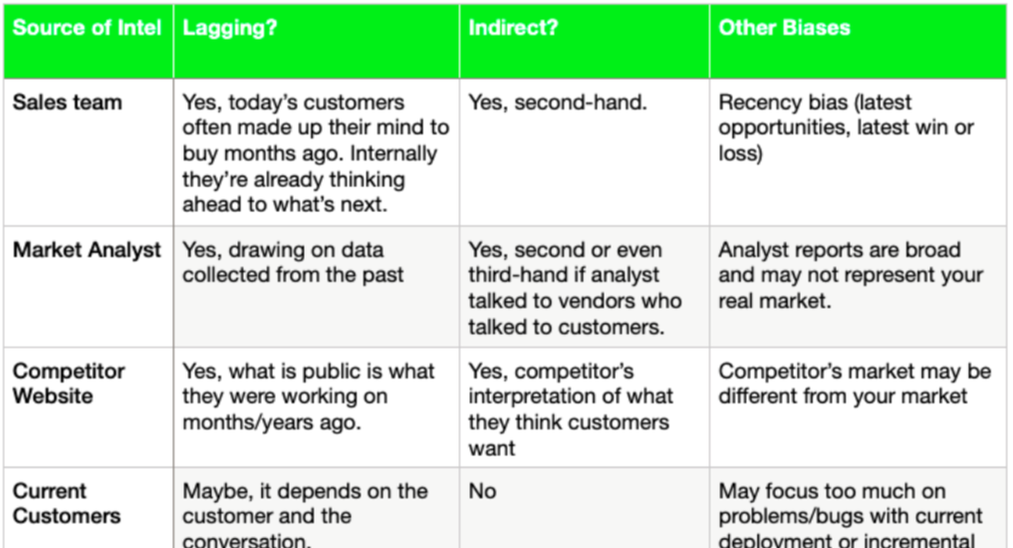

Product leaders know they need to tailor their roadmap to customer demand. They base these decisions on market intelligence from the usual sources:

These sources are important, but are often indirect and lagging information, not to mention other biases. For those that just want to appease their boss, this may be enough. What you release next may or may not be successful, but at least you can show that you based your roadmap on sources. But for those that really care about a product that sells and users love, you need to balance this with more direct and predictive sources of intelligence. |