|

Earlier this year I wrote a tongue-in-cheek post to illustrate how to 'hack' the LinkedIn algorithm to get a lot of views. It took me 2 minutes to write a post, and I got over 2,000 views just that day.

0 Comments

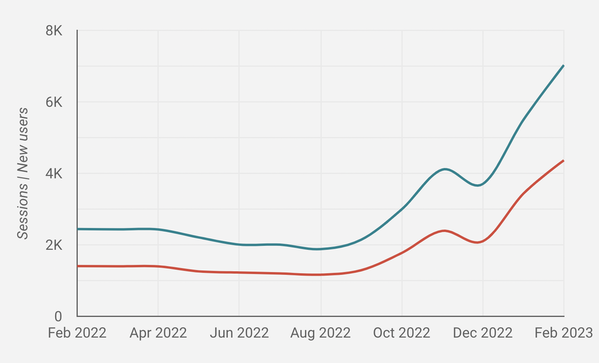

Consultants will tell you that it takes time for a new website to rank highly with Google SEO. Yet I was able to get some of my new website's pages to rank #1 within a few weeks, without any paid ads.

I have done program management, business development and marketing for 20 years, but I'm no SEO expert. But since I had some success just experimenting with SEO part-time, I thought to share my findings. A marketing and sales funnel has multiple stages:

It can be encouraging and disappointing all at once if your team has worked hard to generate marketing qualified leads (MQLs) but somehow they just aren’t converting to actual revenue. For SaaS stores, this can look like lots of sign-ups but few actual transactions. In a traditional B2B company, you might see a lot of activity - website visitors, webinar attendees, trade show booth visitors, and even direct requests for a quote - but conversion to sales is low. What’s going on? It can be tempting to point fingers, but this is almost always a system problem more than any particular team's failing. Here’s a checklist to help diagnose.

Most companies are laser-focused on meeting the current quarter's target, with an all-hands-on-deck effort by sales, marketing and product to close the gap by quarter-end. There is usually also a funnel of opps and leads for next quarter. But what about 2 quarters out?

Short-term revenue is the lifeblood of the company - you don't survive very long if you don't make your number. So companies get good at meeting their target quarter-to-quarter. But one day the current quarter does not look good. The funnel is just not there. Maybe you've saturated the market, or there's been a disruption, or maybe you just didn't have enough funnel-generating activity 6 months ago. Now you're in trouble, and no amount of short-term execution can solve it. Don't fall into this trap! Read any article on product/market fit and it will say "Talk to customers and focus on their problems. It took us 2 years but we found our product/market fit and sold for $X!". One thing? Simple! Talk to customers.

But there's a startling lack of practical guides on how to actually talk to customers to elicit and qualify pain points. And there are so many false pains that you can latch on to in customer conversation if you don't know what you're doing (which may explain why that article invariably says "it took us 2 years to find what customers wanted"). Let's look at the reasons why actually getting to a real customer pain point is so hard, and how to do it right. "Know your audience". "Understand the buyer." "Be customer-centric." The key to lead generation and growth has been in MBA 101 textbooks since the dawn of time.

These 101 textbooks also say to capture the relevant information about your target buyer in the forma of a persona. But the vast majority of teams don't actually create personas, or use them in the right way. Ten years ago, as long as you had a great product idea, growing a tech business was straightforward. But today the market has reached a level of noise that even the best products can't cut through. The average person sees 3,000 ads a day. Promotional channels from Google SEO to Facebook to Amazon are saturated and in constant flux. How do you cut through the noise?

Product leaders are inundated with data. SaaS product and website analytics can slice and dice every aspect of the customer journey. I can see that 22% of my customers between the ages of 30 and 40 spent over 3.2 seconds looking at the new graphic on my website. I know that 16% of freemium users converted to paid in the last month since we added 3 new features.

Quantitative measures like this can point to areas of interest that require investigation and experimentation, but they won't tell you why these are of interest. Qualitative data, ie. talking to people, gives you the why. Qualitative data tells you what was motivating the user when they spent 3.2 seconds looking at your graphic, what problem they were trying to solve. You need both, quantitative and qualitative. B2B companies have woken up to the idea of marketing their business by writing content: articles, blog posts, fact sheets, and case studies. But with so much competition, the writing has to be the best in its category in order to stand out above others. How do you ensure what you are about to write is clearer, more interesting, more valuable, and ultimately gets more views than the competition?

As a product leader, you need customer intelligence to plan your strategy. But the customer data you collect from sales is biased. The data you get from market analysts is indirect. Even the data you collect yourself from customer interviews can be artificial, as customers are all too willing to be positive and tell you what you want to hear.

But there is one undeniable source of raw unfiltered customer intelligence that is too often overlooked - the Customer Success team. The Customer Success team gets customers when they are at their most passionate, emotional, even angry. Where there's emotion, there's usually a real pain point. It's rare to find that sort of honesty elsewhere. |