|

Product leaders know they need to tailor their roadmap to customer demand. They base these decisions on market intelligence from the usual sources:

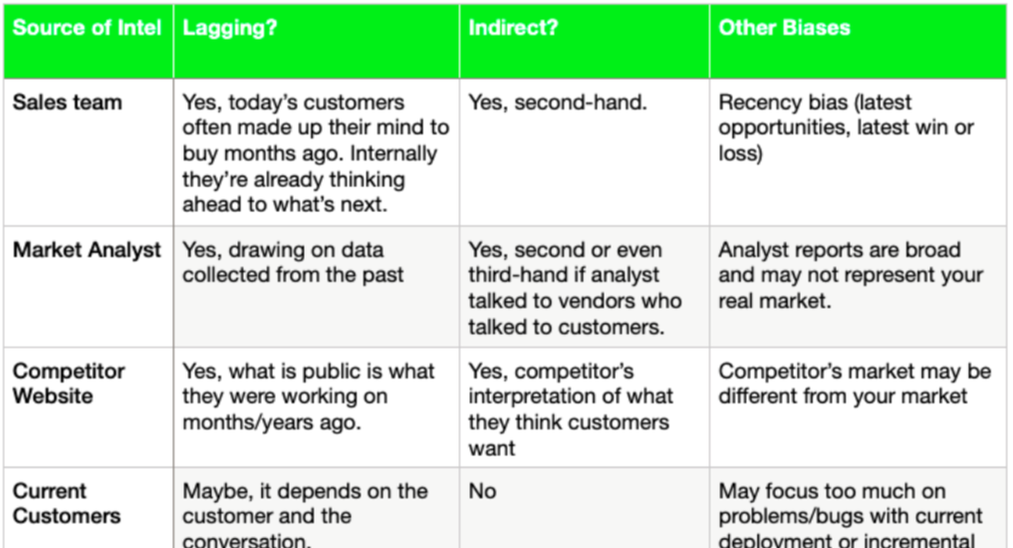

These sources are important, but are often indirect and lagging information, not to mention other biases. For those that just want to appease their boss, this may be enough. What you release next may or may not be successful, but at least you can show that you based your roadmap on sources. But for those that really care about a product that sells and users love, you need to balance this with more direct and predictive sources of intelligence.

Typical Market Sources

Every source of intel has biases. These "typical" sources are valid and important, but incomplete. In particular they are incomplete in a few keys ways:

10 WAYS TO GET PREDICTIVE CUSTOMER INTELLIGENCE

To get your ear to the ground, complement your research with these 10 tactics

1. COLD OUTREACH AND NETWORKING

Talking to existing customers is not enough because it leaves out all the others in your target market. So how will you get in front of all the other potential customers (prospects, competitors' customers, and people in your target market who have not heard of you)? The most talented PMs I know are mini-entrepreneurs that pride themselves in building up a network of these potential customers to talk to.

2. ONLINE FORUMS

If you offer a product that enhances Microsoft Dynamics for example, you should be a regular reading people's questions on Dynamics forums. If you offer security consulting, spend an hour a week on a popular security forum where your potential customers are asking questions. Even general websites like Reddit have active forums on just about any topic.

If your target customer is a C-level, this person may or may not be posting questions on these forums. If they are, great! You get to read what those C-levels are asking about. If your target C-levels aren't on forums, you may find their influencers (team members, managed service providers, etc.) instead. You can post on those forums too. But don't post to advertise your product, just ask questions and join the discussion. 3. ASK ON SOCIAL MEDIA

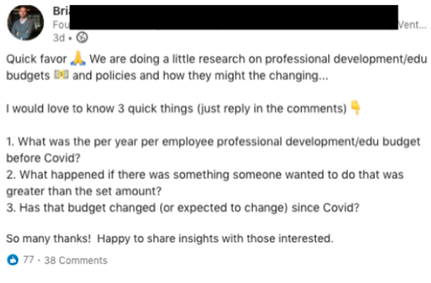

If you are lucky enough that you are connected to your target audience on social media, consider asking your audience for feedback directly. I saw this from an entrepreneur recently, 38 quality responses!

4. SIT IN ON TOP-OF-THE-FUNNEL SALES CALLS

Get more proactive by listening in on prospects who are exploring your company, before they get serious about a sale. What is prompting them to explore? If it's not a problem you solve today, why did they think your company could solve it? What other patterns do you note?

5. WIN/LOSS INTERVIEWS

Win/loss interviews really should fit in the "traditional sources of intel" category, except that they are so rarely done, or done well. Win/loss interviews should be conducted by someone who is unbiased (e.g. not the salesperson who just lost the deal, not a defensive PM who can't hear criticism about their baby). They need to focus not only on the details of the sale that was won or lost, but also for uncovering patterns of customer demand. And they are not just for losses, but should be conducted for wins also!

6. CUSTOMER SUCCESS TEAM

One of the best sources of market intel is actually the Customer Success team. Sales calls and customer interviews can sometimes be a bit sterile or even "fake", as customers go through the motions. They may say they want to buy something and they might not mean it.

But the Customer Success team gets customers when they are at their most passionate, emotional, and sometimes angry. Where there's emotion, there's usually a real pain point. It's rare to find that sort of honesty elsewhere."

What's critical here is to not get wrapped up in a single customer's pain. That's the CS manager's job. What you are looking for are patterns that the Customer Success team hears often.

7. NOT-SO-SECRET SHOPPING

Looking at a competitor's website is like looking at your friend's Instagram - it's a skewed snapshot of them at their best, presenting an image to the world. While there is certainly intel there, it obviously doesn't tell the whole story. Consider talking to your competitor directly. Competitors are people too. You can set limits as to what you want to discuss, and you'll need to share too, but often they will be more forthcoming than you would expect

8. GROWTH EXPERIMENTS

Growth hacking is a simple idea - you put out a "test" to the market and gauge how it does, then repeat. The test can be marketing-oriented, such as a blog post on a topic that deviates from your core message, or a special promotion of a new feature or service. In SaaS, the test could also be product-oriented such as a new feature that you introduce to a segment of your user base. In all cases, you gauge the reaction in terms of readership, leads, usage, or whatever your metric is.

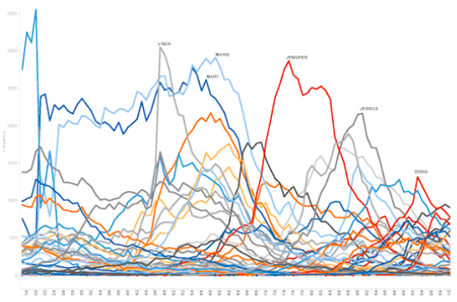

Growth hacking works best when your experiments are already informed by other forms of market intel discussed earlier. 9. SAAS PRODUCT ANALYTICS, MARKETING ANALYTICS, CRM ANALYTICS

We are inundated with products that can slice and dice every aspect of the customer journey. I can know that 22% of my customers between the ages of 30 and 40 spent over 10.2 seconds looking at the new logo on my website, etc. Now even our own SaaS products do this for us, giving insight into every aspect of the product usage.

Quantitative measures can point to areas of interest that require investigation and experimentation, but they won't tell you why these are of interest. Qualitative data gives you the why, the problem that users are trying to solve when they spent an average of 10.2 seconds on that website page. You need both, qual and quant.

10. BE AWARE OF ADJACENT TRENDS

Sometimes companies do all the right things in their markets. They know their customers inside and out. They have battle cards for every feature, every competitor. But they don't see a new wave of innovation, which is coming from another market.

For example, trends in the consumer world often make their way to the enterprise. The iPhone was a user experience innovation in the consumer space. A year later traditional enterprise software vendors were winning deals on guess what? User experience! Similarly hospital software used to be all about medical billing and HIPAA compliance, but if you followed the teleworking movement, you could have predicted the massive wave of remote health. WHAT ELSE?

These are 10 ideas I've used, but surely there are more. What did I forget? What has worked best for you? Of course, you may not have time to do all of these all of the time, and some may not work at all for your circumstances. The point is to ensure you have a continual flow of leading indicators (where the customer is going next), as much as possible from direct sources of intelligence that include not just your immediate paying customers but also all the other potential customers in your market (include prospects, competitors' customers, even people who have never heard of you).

As a bonus, the best product and marketing strategists often find these on-the-ground tactics to be the most fulfilling. The "detective work" required can be a thrill! But most of all this is where you really get to hear what customers are thinking, what they really need, and how you can truly help. Happy sleuthing!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |