|

Product and service offerings follow a growth lifecycle:

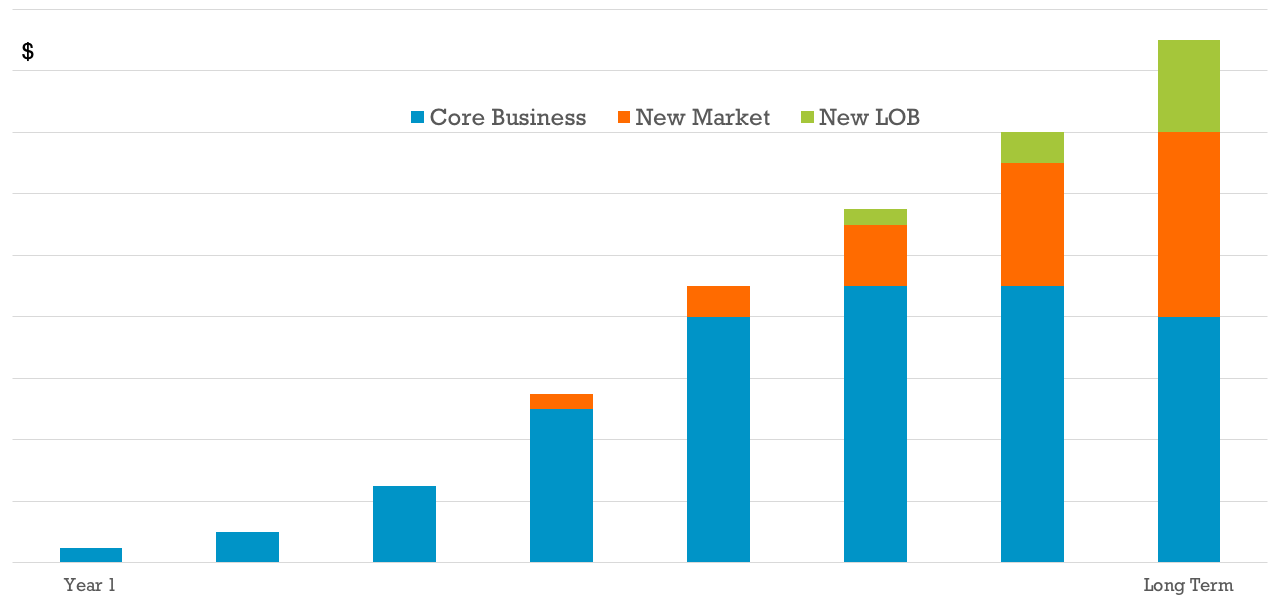

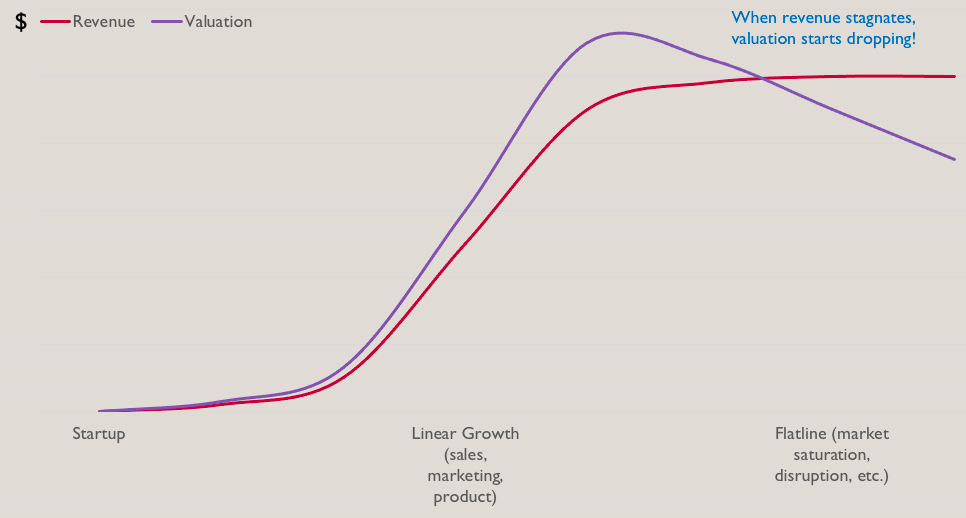

Once you hit Flatline and Decline, it is very hard to bounce back. Stories of flatlining businesses that suddenly take off again are rare indeed. While there are ways to resuscitate a flatlining business, the ideal is to NEVER GET THERE IN THE FIRST PLACE and instead take the right actions to ensure continuous growth. Why Do Companies Get Caught Flatlining? In You Need Multiple Streams, Rob Woodbridge states "Waiting until your primary business is under siege is not the time to think about a second product." This seems so obvious. Of course, at some point, your primary business is going to decline, so why wouldn't you anticipate that and have a plan B? The root cause often happens during the "Growth" phase, the golden years when companies are focused on growing their core business and tend not to put meaningful time into launching new initiatives unless they directly support the core business. Why? Growing a Plan A is hard enough in and of itself Short-term revenue is the lifeblood of the company - you don't survive very long if you don't make your number. Sales, marketing and product teams get very good at meeting short-term targets quarter-to-quarter. They are focused on the short-term because that's what they are asked to do. It's a Herculean task just to make your quarterly target, and there's little time leftover to think about diversifying into new markets, net new products, or a new line of business. Revenue is blinding There is also some arrogance during growth. "Revenue is blinding" an old colleague of mine used to say. When things are going well, it's easy to think there's no limit to how far you can go. It's also easy to let yourself off the hook of giving serious effort to diversifying. You think you have time. Great ideas for a Plan B, but weak execution Of course there are strategy sessions with great ideas - new markets, new products, new partnerships - but the result is often just a grab bag of miscellaneous initiatives that no one quite ever has time for. The issue is not a lack of will but a lack of commitment. Never Stop Innovating If you are a business owner and your core product is flatlining, your valuation is already dropping. You don't even need to be actually decreasing in revenue yet. That's a dangerous place to be! This applies to small companies of course, but it also applies to large ones. As Woodbridge notes "When Blackberry was at its peak it owned the early smartphone industry. Everyone carried a BlackBerry. Then almost overnight they disappeared. As they started to decline in market share they scrambled to compete by releasing other products. They released a tablet after the iPad came out but it was a lesser product in comparison. Too little too late." The goal is diversification during the good times, when you have the resources and the time on your side to pick more winning stocks that may not pay off for a while - a new market, a new product, a new line of business. This is no different from how you would diversify a stock portfolio. Diversification means starting new meaningful streams of revenue, even if they are small to start:

Diversification is also not just a defensive strategy, it's offensive too. Investors don't want a one-trick pony! Valuation goes up if you can credibly show multiple paths to future growth. Not Growth Hacking It surprises me how the Silicon Valley "Growth" movement is so focused on continuous growth of a single product line through marketing channels. SEO, social, viral, etc. If you are betting on being a mega-platform like Facebook or Twitter then maybe that's all you need, but for the vast majority of companies, growth is not just about generating more leads for your 1 product. One day when your market is disrupted or saturated, the leads will inevitably stop and you won't be able to "hack" your way out of that one. It's about layering new markets and new potential lines of business (LOB) to continuously expand. Leverage your Distinctive Competencies To diversify, we're not saying accountants need to also sell ice cream. Your new initiative should leverage your distinctive competencies, the things your organization does best that give it an advantage and are hard for competitors to copy. You also need to be aware of what Steve Jobs called Second product syndrome: "when the company comes up with a very successful first product, it becomes more ambitious and boastful. The company then decides to go ahead with the second product without actually investigating and understanding the reason behind their first product's success. Therefore, the second product often ends up as a failure." Obviously, you need sufficient strategy, market study, due diligence. And no one said diversifying means a new product necessarily, it could simply be the same product sold to a net-new market or a new partnership that will grow even if when your core market starts to flatline. Don't fool yourself into thinking you are diversified when you're not. If you have 10 products but they are really just the same product for different platforms, or all complementary to the core product (like a mobile companion version of the same app), it may sound like a lot but really you just have 10 products supporting 1 line of business. Just like a stock portfolio, your plan B can't be so related to your core business that if your core business starts to decline, your other initiatives go down with it. M&A is whole other option outside the scope of this piece, but even then, the principle remains the same. An acquisition needs to be coherent with your company's distinctive competencies, and you need to be clear on whether the acquisition is for diversification (e.g. new product line, new markets, new customers) or simply doubling-down on what you already do today. Commitment There's usually no shortage of good ideas from within the company on how to diversify though. The trick is not a lack of ideas, but a lack of committed execution. With everyone short-term focused on plan A, who is making plan B happen? Amazon has popularized a new role called the Single-Threaded Owner, an 'intrapreneur' within the company who is given 100% dedicated focus to see a new initiative through to success. In a smaller company, an STO may just be a single person running new initiatives, in a larger company the STO might have a dedicated team. STO is perhaps what "Business Development" was meant to be, before it was co-opted by sales people and alliances managers, or what "Product Managers" can be if they are truly owners of the business they are entrusted to create. Amazon assigns STOs to carry out truly strategic initiatives that require total focus and total accountability to succeed. The Secret of Getting Ahead is Getting Started Waiting until your primary business is "under siege" is not the time to think about a new initiative. The secret of getting ahead is often just getting started. It takes strategy, certainly, to determine which new ideas you will pursue. But above all it takes commitment - a dedicated entrepreneurial leader with focused time to carry out that strategy and make it a reality. This is the essence of real continuous growth. Further reading:

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |